Banks, lenders, payment processors, and other financial institutions manage some of their customers’ most valuable information: their money and their data. That puts financial institutions under constant pressure to comply with data privacy regulations, provide transparency, and have a solid governance framework for their websites. More than most industries, the finance vertical must cultivate the key value of trust to attract and retain customers. 53% of banking consumers are highly concerned about data privacy.

At ObservePoint, we work with 7 of the 10 largest banks in the U.S. (and more internationally), helping them bring order to the chaos of web compliance and functionality. Across the board, we see common challenges that make digital governance harder than it should be:

- Operational inefficiencies: Manual QA eats up valuable resources

- Compliance complexity: Multiple domains across countries mean juggling GDPR, CCPA, LGPD, and more

- Legacy systems: Syncing modern automation tools across multiple legacy systems with different logged-in states can be a challenge

- Lack of automation: 42% of financial institutions still rely on manual processes for compliance

If any of that sounds familiar, you’re not alone. The good news? With automation, website compliance risks, operational overload, and manual processes can be left where they belong…in the past.

Let’s dig into what we’ve uncovered.

What a Website Audit Reveals About the Finance Industry

We ran a scan of 500+ financial institution websites, diving 10 pages deep from the homepage. The results were eye-opening—and offer a benchmark you can measure your own site against. For example, did you know that 94% of all CMPs we’ve scanned have implementation issues? Read on for the details specific to finance companies.

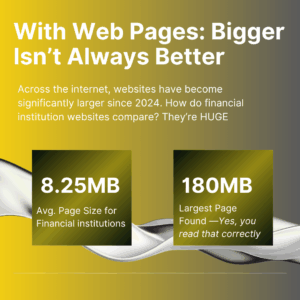

Page Performance: Bigger Isn’t Always Better

Web pageshave been getting heavier every year. In 2024, the average page size of websites was at 2.6MB. Financial sites? Way above that.

- Average page size: 8.25MB

- Largest page we found: 180.43MB (yes, really)

Heavy pages mean slower load times, which hurts user experience and SEO. Want a quick win? Trim the fat—especially old or unused tags (more on that below).

Web Vitals: Pretty Good Overall

Largest Contentful Paint (LCP)

How long does it take the biggest element on your page to load?

- Target: < 2.5 sec

- Finance avg: 2.43 sec

- Worst case: 83.6 sec

✅ On average, financial institutions are doing well here. Keep it up.

Time to First Byte (TTFB)

How fast does your server respond?

- Target: < 0.8 sec

- Finance avg: 0.41 sec

- Worst case: 51.02 sec

✅ Another strong showing. Fast servers = happy users.

Cumulative Layout Shift (CLS)

How visually stable is your site? Do elements jump around while loading?

- Target: < 0.1

- Finance avg: 0.12

- Worst case: 3

⚠️ A bit over target here. That bounce or flicker might seem small—but to users, it’s frustrating.

Tag Bloat: Old Code, New Problems

Outdated tracking tags slow down your site and can interfere with data collection. We found that:

- 34% of finance websites still use the deprecated Google Universal Analytics tag

Cleaning up unused tags is tedious—but automation makes them easy to spot. The ObservePoint platform can scan every page and tag on your site, boosting QA productivity by 25% or more.

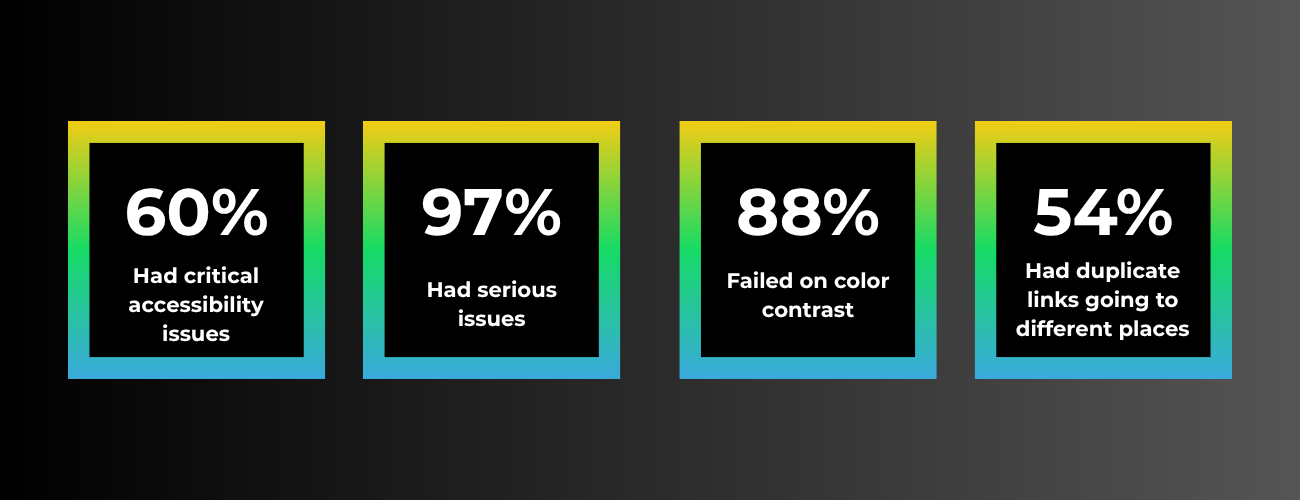

Accessibility: A Priority, Not a Checkbox

With laws like the ADA in the U.S. and the new European Accessibility Act (EAA), digital accessibility isn’t optional.

From our scan:

- 60% of finance pages had critical accessibility issues

- 97% had serious issues

- 88% failed on color contrast

- 54% had links with duplicate text but different purposes

Accessibility matters—not just to avoid legal trouble, but to serve the 2.2 billion people worldwide with visual impairments. A more inclusive site is a more trustworthy one.

Privacy Compliance: The Gaps Are Real

Last year alone, GDPR fines hit €1.2 billion. That’s a big number—and the risks aren’t just for Big Tech like Meta and LinkedIn. We scanned for advertising and social media trackers with both GPC signal on and off on financial sites.

Here’s what we found:

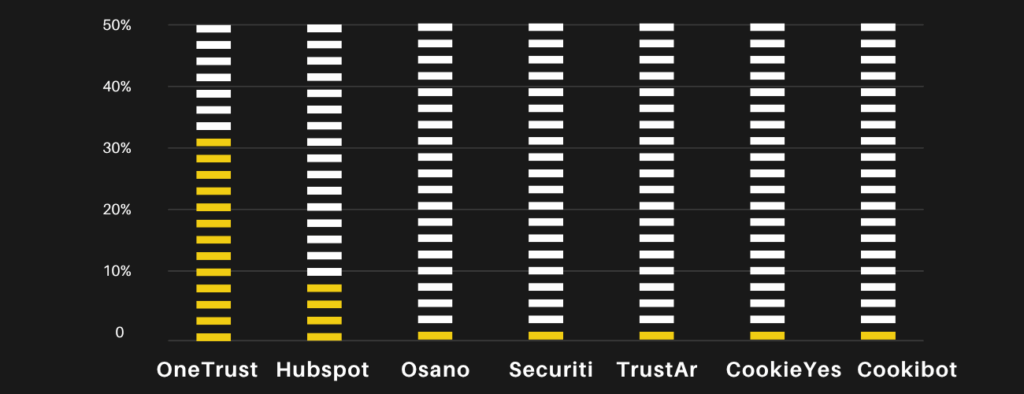

Consent Management Platforms (CMPs)

- 51% had no recognizable CMP

- Most common CMPs:

Consent Management is the first step in receiving and honoring your visitors’ consent preferences. Even so, 94% of CMPs we’ve scanned have implementation issues. Like any software, validating their functionality and performance is a must. Even if you’ve built your own CMP, make sure to double-check that it’s working as you intend. We’ve seen plenty of examples where cookies are being dropped before users consent—or despite opting out.

Global Privacy Control (GPC)

GPC is a browser setting that allows users to signal a universal opt-out. When users enable GPC, your site should respect that signal. But we found:

- 74% still had advertising trackers

- 60% had social media trackers

- 46% were still using the Facebook pixel

- 75% of pages still placed 3rd-party cookies even when denied

- Most common 3rd-party cookies: Google, LinkedIn, Adobe.

We isolated some of the European websites of financial institutions:

Without giving consent:

- 50% were still dropping 3rd-party cookies

- 54% still had advertising tags

- 46% had social media tags

That’s not great. Neither is this: some European sites are still sending user data to restricted geographies like the U.S., Canada, and Japan—a major GDPR red flag.

Let’s Fix This Together

You’re not expected to be perfect, but you should be progressing. Automating your website governance isn’t just about compliance; it’s about earning (and keeping) your customers’ trust.

We’ve helped leading financial institutions streamline their audits, fix hidden issues, and get peace of mind across every domain.

Want to know how your site compares?

Click here to get a sample audit and see where you stand.